What You Track, You Can Transform

“Budgets.”

Even as a seasoned financial planner, that word makes my shoulders droop and my spirit feel a little sludgy.

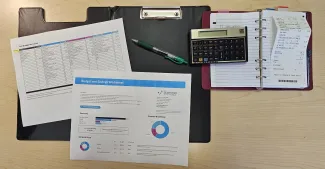

Sometimes, though, you just have to buck up and face it. There are plenty of budgeting tools out there, but I hadn’t tried one in a while. Quite frankly, that’s because I find the whole process a bit tedious. Then I came across a simple spreadsheet that looked more promising than most. I decided to give it a go, and I’m glad I did.

I didn’t use it to build a traditional budget. Instead, I used it to review our actual household cash flow over the past year. I already had a good sense of where the leaks were. Earlier this year, I’d donned my archeologist’s hat and excavated our 2024 spending. But even so, this exercise surfaced a few fresh insights.

The worksheet provides a snapshot of how your cash flow lines up with the 50/30/20 guideline — a framework that suggests allocating:

- 50% of your income to Needs (housing, groceries, healthcare, etc.)

- 30% to Wants (dining out, hobbies, travel)

- 20% to Savings & Debt Repayment (retirement accounts, emergency fund contributions, or paying down credit cards and loans).

At first, I wasn’t sure how I felt about grouping savings and debt repayment together. But I came around. Both are actions that strengthen your financial footing. It’s a framework, not a mandate, and it offers a useful way to reflect on how aligned your spending is with your values and goals.

Why This Tool Might Work When Others Haven’t

Let’s be honest: creating a budget isn’t usually anyone’s idea of fun. It’s the sort of undertaking where I’m tempted to mutter, “Forget it. Too much work. I don’t have time.” This tool, though, has a few things going for it:

- It’s visual and interactive. You can immediately see how your spending stacks up.

- It’s flexible. You can skip categories that don’t apply and add your own.

- It’s forgiving. It doesn't require perfection. "Good enough" really is good enough.

- It meets you where you are. Whether you want to track monthly or annual cash flow, it works.

Tips to Make the Process Feel Less Overwhelming

Start where you are. You don’t need to do it all at once — and you definitely don’t need to account for every penny. Use a “Miscellaneous” category if you must, and give yourself permission to be approximate. Some insight is far better than none.

Here’s one way to begin:

Download the worksheet (linked below).

Decide on your scope — monthly or annual review.

Gather your statements — bank, credit card, recurring bills.

Fill in the numbers that are easy to find first.

Use estimates or placeholders when you’re unsure.

Take a breath — then look at your 50/30/20 breakdown.

Notice what you notice. Where’s the imbalance? Where’s the opportunity?

If you’re like me, the real reward comes when you get to share your findings with a partner or friend. I didn’t love what I saw in my first run-through, but I appreciated having hard data. It gave me a solid framework for money conversations with my husband. And honestly, that alone was worth the effort.

A Gentle Challenge

You may even start to feel the thrill — yes, thrill — of having more control over your financial life. You might catch yourself getting curious about where you could trim a bit here or shift a bit there. It’s not about restriction; it’s about discovery.

One thing is certain: you won’t know until you begin. I believe in small steps — even tiny ones — because they create momentum. The Japanese have a term for this – Kaizen, which translates to “continuous improvement.” So how about this: schedule just one hour on your calendar. That’s all. One hour to gather a few financial statements and dip your toes into this exercise.

You might be surprised by what you uncover. You might even find a bit of gold.

👉 Ready to try it for yourself?

Download the Budgeting & Saving Worksheet here.

It's free, flexible, and infused with a spirit of possibility.